A – Z of Healthcare

Merging High Growth and Impactful Change

VEV drives value by investing in scalable healthcare solutions that are both horizontally and vertically integrated, delivering synergistic impact and enhanced financial ROI while elevating healthcare delivery to new heights.

VEV leverages AI as an overlay to supercharge outcomes and plans to expand its successful blueprint from North America to high-growth regions such as the Middle East, India, and Latin America.

Macro Trends or Underserved Markets Driving the Opportunity

Technical Innovation

AI-driven healthcare solutions, such as diagnostics and personalized medicine, are revolutionizing the industry. However, these technologies are still underutilized across all regions and geographies including in emerging markets.

Aging Population

Globally, populations are aging, and health care is steadily moving to home, leading to increased demand for hospitals with in home care options, multi- specialty services, and longevity-focused solutions. Bringing these solutions together in a seamless fashion while also providing synergy to a unique mix of mature and start-up companies will create a unique and stable fund proposition.

Global health Disparities

Many emerging economies lack adequate healthcare infrastructure. This creates opportunities for investments in hospitals, biotech, and AI to bridge gaps.

Preventative Care

Wellness and preventative healthcare markets are expanding as more consumers prioritize long-term health over reactive treatment.

A Strategic Investment Blueprint

The fund aims to invest in high-growth healthcare ventures across diverse verticals, leveraging synergies between projects for exponential value creation.

Healthcare sectors such as hospitals, biotech, multi-specialty practices focusing on MSO & DSO, mental health, AI in healthcare, and wellness.

Primarily focused on the U.S., with expansion into emerging markets in Middle East, India and Latin America.

Mid-market, established projects for scalability and high-growth early-stage ventures in innovation-driven niches.

Strong leadership with industry expertise, including Dr. AJ Rastogi and Ramesh Kumar. A panel of partners comprising global leaders who are prominent figures in medicine, biotech, finance, startups, scale-ups, and growth hacking.

Exclusive access to deal flow and healthcare innovation networks. Proprietary operational frameworks integrating synergistic projects.

What We Bring to the Table

Proven Expertise

Extensive expertise in tech and healthcare, with a strong track record in growth hacking and scaling startups. Skilled in adopting technologies that improve efficiency and drive customer-focused growth.

A Powerful Network

A wide network of empannelled professionals across industries, providing the support and resources needed to ensure the success of new initiatives.

Purpose-Driven Teams

Commitment to assembling teams that are passionate about solving complex challenges, focused on delivering impactful solutions, and driving sustainable, long-term success.

Value Creation

Market Size & Fund Target

Risk Management

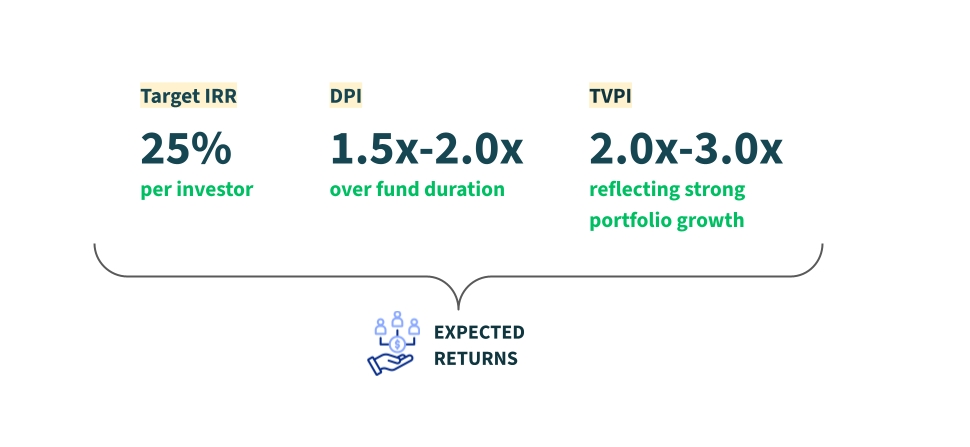

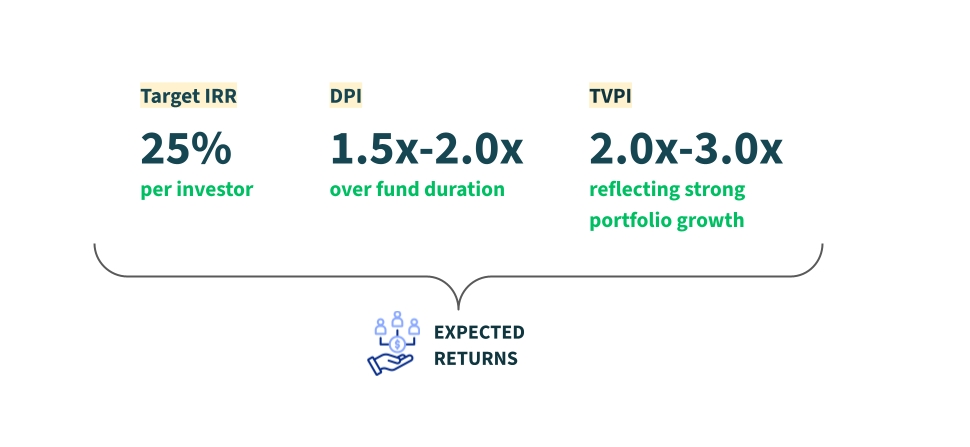

Financial Projections & Returns

Exit Strategies

Fund Managers

Dr. AJ Rastogi

A healthcare visionary with extensive experience in growth-focused ventures.

Ramesh Kumar

A seasoned strategist with track record in Idea to Exit growth hacking, operational scaling at global level, fundraising and financial structuring.

Advisors Partners

Include Legal, Financial, Venture Capital, Private Equity, Cross Border Growth Hacking, domain experts to solidify the fund’s foundation and execution capabilities.

Dr. Saju Joseph

Dr. Achintya Moulick

Dr Romesh K Japra

Peter Verbica

Dr. Prasun Mishra

Dr. Naresh Sharma

Gans Subramaniam

Jonathan Morgan

Subra Iyer

Dave Sanders

Ramesh Santhanam

Bala MS

Dr Madan Mohan B

Dr Usha Sriram

Rajesh Ramachandran

Jeff L.

Russell Authur